The increasing commercial gaming development opportunities taken on by Native American Indian tribes and First Nations today is obvious. More than a handful of tribes now have gaming operations located outside their tribal lands, financed by their own private equity funds.

In the following analysis, we explore the history and context of commercialization within indian gaming and its potential future direction, reveal the composition of current tribal commercial properties and portfolios, explore the advantages tribes rely on in commercial environments and consider how commercial tribal assets might fit into the future of the gaming industry.

Background: Tribal Gaming in Commercial Markets

Tribes with investment resources stemming from gaming cash flow initially were focused more on diversification outside of gaming—many had ownership positions in a variety of businesses, but investment capital was limited and risk was quite measured.

More recently, tribes have recognized the disproportionate value they bring to gaming and hospitality developments, and are increasingly comfortable investing in an industry they know well. This has redirected much of that investment back into the gaming industry.

Caesars Southern Indiana hasn’t changed names, but it has changed owners. The Eastern Band of Cherokee Indians, owners of Harrah’s Cherokee in North Carolina, bought it last year and now operates it.

Tribes involved in commercial enterprises have several things in common: (a) highly successful trust land-based operations yielding substantial free cash flow; (b) entrepreneurial and risk-tolerant enterprise structures; (c) communities willing to put otherwise distributable funds to work as investments; (d) long-term views on economic development; and, (e) the desire to be licensed by commercial gaming regulators. Of course, they also must have communities open to commercialization at all. Some, if not all, tribes involved in commercial gaming share these characteristics.

The road to commercial gaming investment by tribes dates back more than 15 years, having gained momentum following the Mohegan Tribe’s entry to the Poconos market in 2005, followed closely by the Seminole Tribe’s acquisition of Hard Rock International in 2006. Mohegan Chairman James Gessner reflects on the tribe’s past in gaming existentially in the emergence of commercial tribal gaming operations:

“We have always challenged ourselves to break barriers, not just for our own tribal members but for natives throughout Indian Country,” says Gessner. “For nearly 30 years, starting in the 1990s, we were the first Native American tribe to go to Wall Street and access public financing. We continued to charter new territories going off-reservation into commercial gaming in Pennsylvania in 2006, and more recently became the first Native American tribe to operate a casino in Las Vegas—all while expanding into international waters with properties in Canada and properties under development in South Korea.

“Our successes have given us the unique opportunity to help fellow tribal nations looking to diversify, offering expert advice and services that enable them to provide critical services to their citizens. And through these successes, we can contribute to the communities in which our tribal members live and in which we operate our businesses.”

Recent Developments and the Future Role of Tribal Commercial Development

The former Sands Bethlehem was bought by Alabama’s Poarch Creek Band, and is now Wind Creek Bethlehem

Given this context, how do moves by tribes into commercial gaming fit into the overall direction of the gaming industry? The answer is found, in part, in the general direction of gaming.

In late 2019, The Innovation Group reported on the palpable introspection surrounding organizational and structural changes among casino operators, and legitimate confusion regarding the strategic direction of the online and traditional casino gaming industries. Uncertainty was the result of several converging influences.

First, traditional growth opportunities through market expansion had diminished. If this was a hinderance for commercial operators, it applied more so to tribes that had typically operated on limited tribal trust land.

Second, generational change combined with the rise of new and disruptive technologies was and still is making it difficult to understand what gaming products and amenities will be most desirable in the future. Since that time, sports betting and online gaming have become potentially even more significant in tribal markets than in commercial ones.

The key trends we highlighted in 2019 included portfolio consolidation, real estate disaggregation (into REITs) and new business combinations. Tribal acquisitions (versus greenfield development) of more prominent gaming assets in commercial markets could have been mentioned as an accelerating trend. If the $300 million investment by Seminole Hard Rock Gaming in 2017 seemed impressive at the time, the more than $1 billion acquisition of the Sands Bethlehem property in Pennsylvania (now Wind Creek Bethlehem) by the Poarch Band of Creek Indians in 2019 set a new bar.

Arthur Mothershed, Poarch Creek tribal member and executive vice president of business development and government relations for Wind Creek Hospitality, commented, “Identifying and taking on projects outside of the tribe’s backyard has been a great way to leverage Wind Creek’s development and operating experience, and unleash tribal investment capacity. These growth opportunities will contribute critically to the long-term economic viability of our community.”

Last year, the Eastern Band of Cherokee Indians (EBCI) acquired Caesars Southern Indiana. “EBCI’s entrance into commercial gaming was calculated and methodical, a maneuver that had been under consideration for some time. All in the spirit of economic diversification for the tribe,” said Scott Barber, CEO of EBCI Holdings, LLC. “EBCI studied the pioneer work of the Mohegan, Seminole and Poarch Creek tribes and determined the best organizational structure and corporate strategy to enter the commercial gaming space.

“The conclusion of the ERI & CZR merger accelerated EBCI’s plans and created the opportunity to pursue Caesars Southern Indiana as our first acquisition. Hopefully, the first of many to come as EBCI’s commercial entity focuses on growth over the next decade.”

Las Vegas, the worldwide capital of commercial gaming, now also has become a part of the story with the acquisitions of the Palms by the San Manuel Band of Mission Indians and most recently, the Mirage by the Seminole Tribe of Florida.

Status of Commercial Casinos Owned and/or Managed by Tribes

Hard Rock International, owned by Florida’s Seminole Tribe, has many commercial casinos and hotels, including Hard Rock Atlantic City

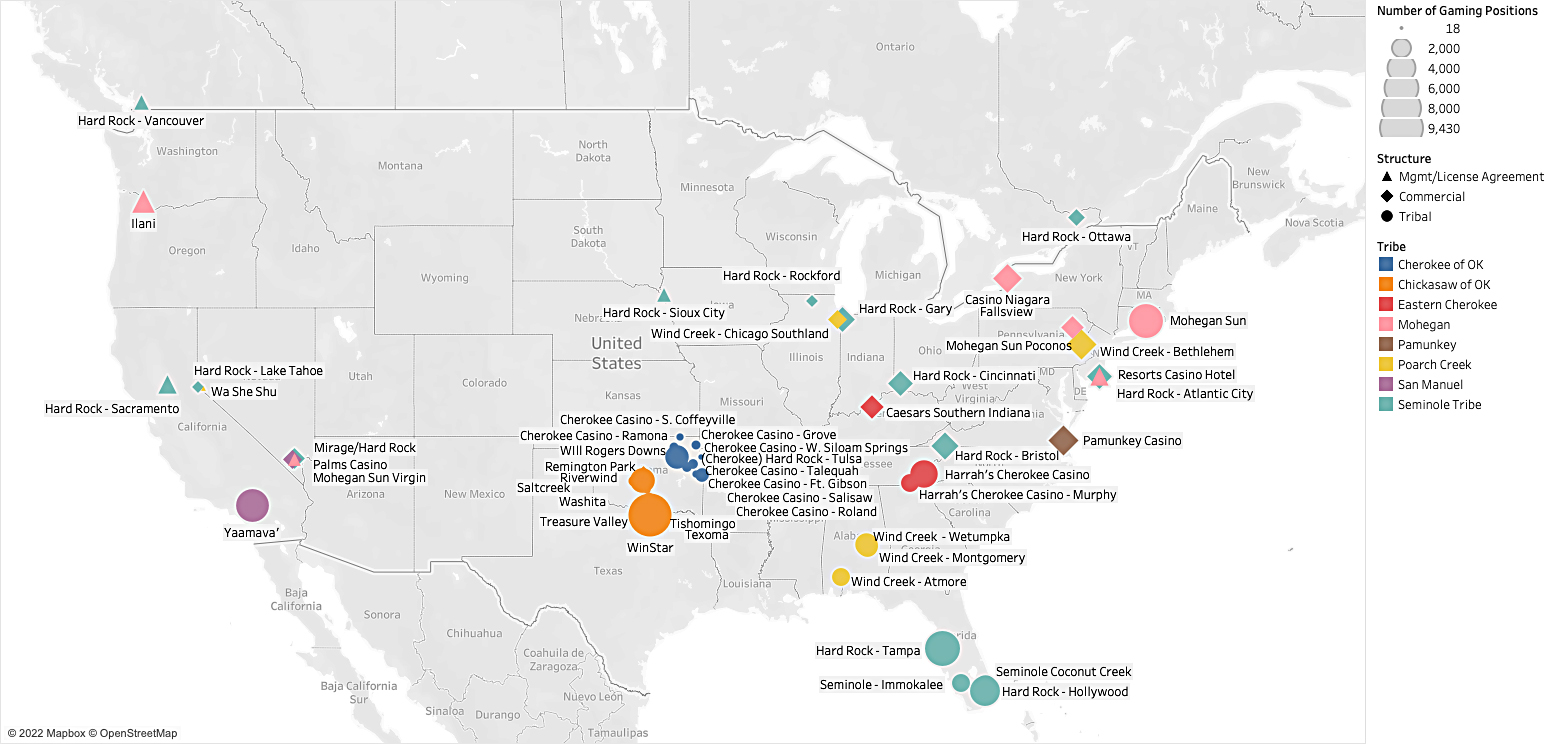

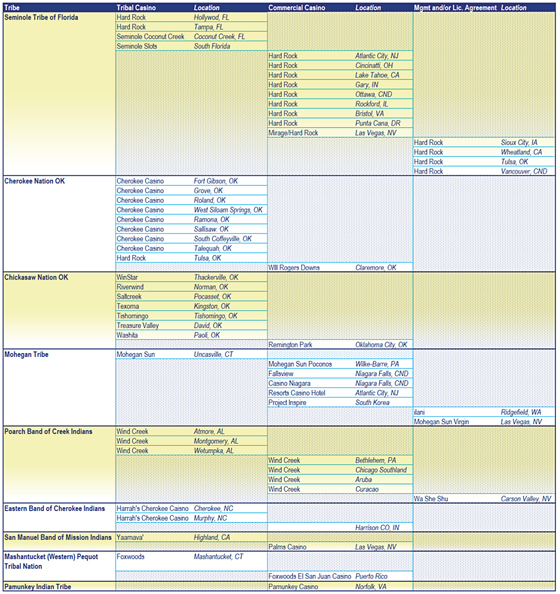

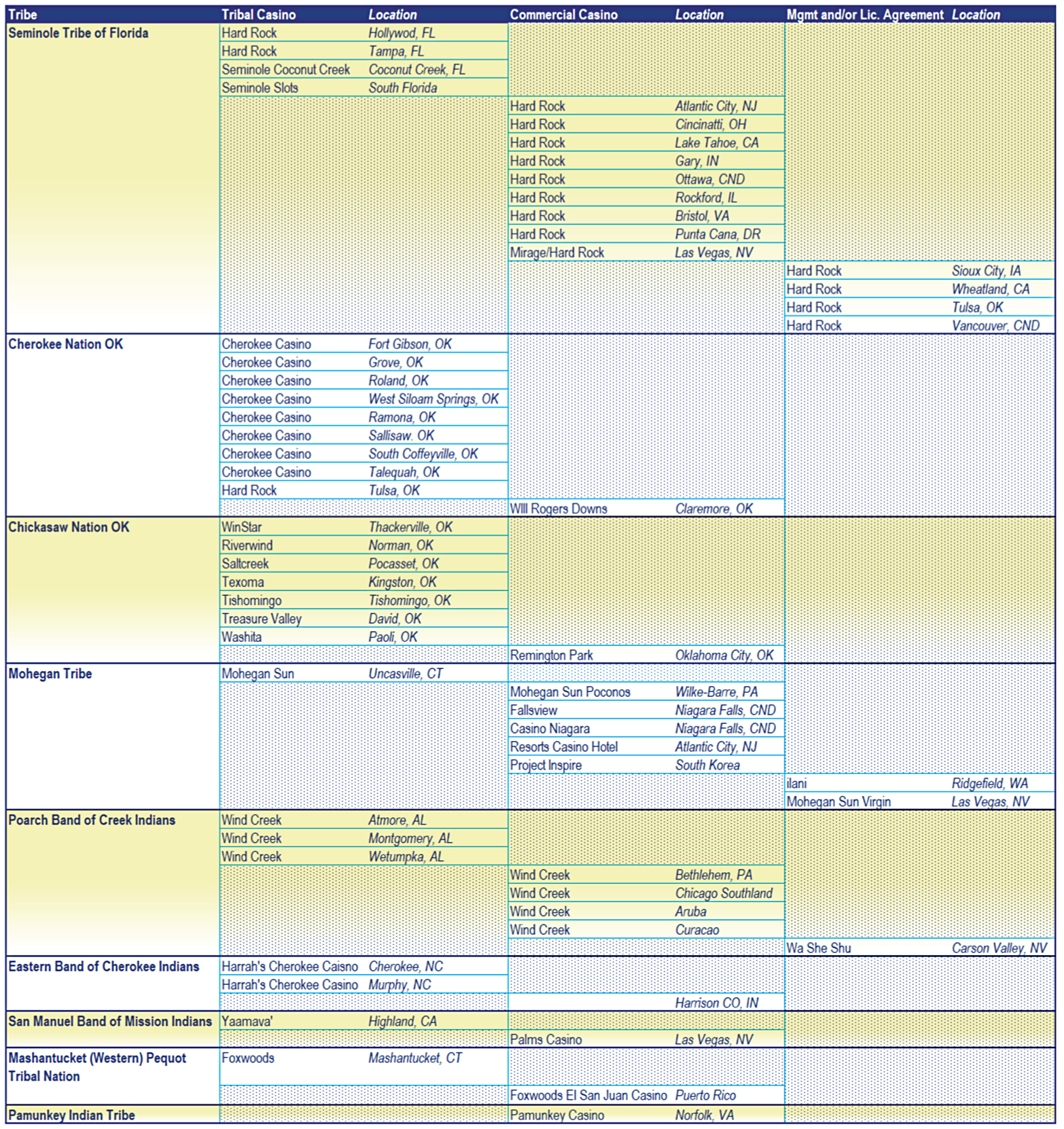

By our count, there are now more than 25 properties in commercial gaming markets owned and/or operated by Native American tribes. The table at right demonstrates the geographic reach of tribal commercial portfolios.

The map below lays out the chart transactions geographically. Below, each dot represents a tribal or commercial casino. Each tribe is colored differently, with properties on sovereign land appearing in a light shade and properties in commercial markets in a darker shade. The size of the dot reflects the relative difference in the physical size of the properties measured by gaming positions.

Potential Strategic Advantages for Tribes in Commercial Markets

There are several strategic advantages enjoyed by tribes in the contest of outside investment. First, tribes entering the space have substantial cash availability. While there is a short-term opportunity cost to internal tribal investment or distributions, gaming tribes thinking in the longer term can dedicate significant capital to these projects. In fact, longer-term investments by tribes are a natural fit. Where commercial companies may seek an exit, tribes are investing for multiple generations.

Second, tribes can enjoy very low cost of capital in states with favorable gaming compacts, where EBITDA margins can be in the 50 percent-plus range. Finally, the drive for profitable off-site developments by tribes is, in a way, more personal. Growth to serve shareholders in commercial enterprises is obviously an existential goal; however, investing in assets for the equivalent of a large, extended family can be an even more powerful motivator.

Trend or Phenomenon?

Will tribal expansion into commercial gaming markets be a major factor in the future of the industry? We believe so. We see the expanding enterprise as equally attractive to large tribal operators and large commercial operators. While we have focused on strategic advantages enjoyed by tribes, large-cap commercial operators have their own. Included are scalability, a diverse cross-market customer base, and the ability to shift to an opco/propco, REIT-driven model with relative ease. (REITs are an unproven model for tribes on tribal land and otherwise rare in practice by tribes with the notable exception of the Eastern Band of Cherokee REIT deal with VICI Properties in Southern Indiana.) That said, tribes should continue to have an edge on cost of capital and benefit from the longevity of their enterprises, powerful differentiators that should help shape a successful future for tribes investing in commercial gaming.

Tribal Casinos w/ Mixed Portfolios (Tribal Casinos, Commercial Casinos, and/or Management/License Agreements)

As of March 2022

The following map lays out the above transactions geographically. Below, each dot represents a tribal or commercial casino. Each tribe is colored differently, with properties on sovereign land appearing in a light shade and properties in commercial market in a darker shade. The size of the dot reflects the relative difference in the physical size of the properties measure by gaming positions.