When the Supreme Court struck down the Professional and Amateur Sports Protection Act (PASPA) in 2018, it was a seminal moment for the gaming industry. Suddenly there was a new and dynamic wagering product that would attract an entirely new demographic to the business. New Jersey casinos and racetracks were the first to introduce sports betting outside Nevada, and today more than 30 states and jurisdictions now permit the wagers.

For tribal gaming, however, it isn’t that simple. In general, tribes can only offer games that are included in the compact struck between tribe and state. So adding sports betting often requires reopening the compact—something tribes are reluctant to do, because it gives the state the opportunity to add or subtract other things from the agreement. Even so, some tribes went forward.

In New Mexico, there was no prohibition against sports betting. The compact there allows any and all Class III gaming on tribal lands. PASPA was the only overriding law that prevented New Mexico tribes from taking sports wagers. Once that law was overturned, the Pueblo of Santa Ana decided to test the waters, and the state attorney general raised no objections. The Santa Ana Star Hotel Casino hired US Bookmaking, the company controlled by venerable Las Vegas bookmaker and Gaming Hall of Fame member Vic Salerno, to run its sportsbook. The reasons for offering sports betting in Indian Country are no different than those cited by commercial casinos.

“Sports betting has a very small house advantage and is quite labor-intensive,” says Santa Ana Star Casino Hotel CEO John Cirrincione. “Since we won’t be taking the big bets you’d see in Las Vegas, our net profit projections are between a small profit and a small loss. Our intent of adding the sportsbook is to add another amenity for guests, but not necessarily as a significant profit center.”

John Salerno is director of operations for US Bookmaking, which was recently acquired by Elys Game Technology. He says he knew Cirrincione from the Sands in Reno, where the predecessor to US Bookmaking, Leroy’s Sports, ran the book.

“He wanted to be first, and knew we could deliver on an accelerated time frame,” says Salerno. “He basically told me, ‘Just put a Leroy’s book in.’ We opened the sportsbook 45 days after signing the agreement.”

US Bookmaking ran several sportsbooks in commercial casinos, and Salerno says there was only one difference in opening a tribal sportsbook.

“The one major difference is that tribal casinos are regulated by their own tribal gaming divisions, versus commercial casinos being regulated by state gaming divisions,” he says. “We had to work with the tribe’s gaming division and the casino management to develop the sportsbook regulations, internal controls and procedures.

“From an operations standpoint, it’s very similar to a commercial casino sportsbook.”

Nuts & Bolts

Sportsbook at Seneca Buffalo Creek

The decision to open a sportsbook can be agonizing for tribal officials. Many tribal casinos are off the beaten path, and traveling to them takes some time and effort. So a sportsbook can be a great way to attract new visitors. Yes, the sportsbook by itself isn’t a huge financial windfall, but it can bring in new customers who will spend significant time at the property, betting on and viewing sporting events.

On the other hand, mobile sports betting can be extremely lucrative, because it takes bets from players who aren’t necessarily at the casino. While mobile may decrease casino visitation, it will produce more frequent bets, therefore more frequent revenue.

Joe Asher is president of sports betting for IGT, and formerly ran William Hill US, one of the first mobile sportsbooks in North America. He says the technology required to run both retail and mobile sports betting can be intimidating, one of the reasons his company has been so successful in deploying the IGT sports betting packages.

“Tribes already have a relationship with IGT both through the games and the IGT Advantage system,” Asher explains. “That gives us a big advantage when it comes to the trust that’s necessary when a tribe joins with a sports betting technology partner.

“The IGT Advantage system is very modular and many tribes already have it in-house. There’s a big focus on payment processing, a very important aspect of sports betting whether you’re talking about retail or mobile.”

IGT recently opened a sportsbook at an Oneida casino in Wisconsin, where at least a dozen sports betting kiosks were installed.

“Kiosks are very popular with customers,” Asher explains. “They’re not unlike the ATMs people use these days when they go to the actual bank. We’re able to keep the infrastructure costs relatively low and serve their customers on a cost- efficient basis.”

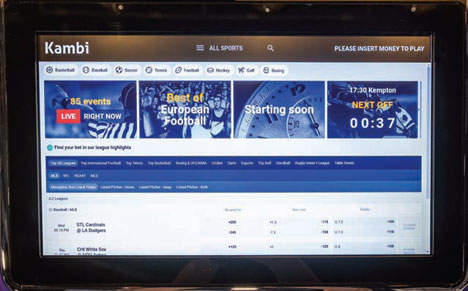

Kambi is a technology provider based in Sweden that was an early entrant into the U.S. market.

Kambi is a technology provider based in Sweden that was an early entrant into the U.S. market.

“With the repeal of PASPA opening the doors to legalized sports betting in the U.S., Kambi was an early mover, accepting the first sports wager outside of Nevada in August 2018,” says David Bretnitz, senior director of U.S. sales. “Tribal casinos were faced with the opportunity of launching a completely new vertical for the first time. Kambi’s rich sports betting heritage as well as industry experience allowed us to engage tribes from the very beginning.

“Tribes understand that a sports betting operation can help drive significant returns for their communities—not just through the sportsbook itself, but across gaming and hospitality as a whole. In the years following PASPA’s repeal, Kambi has formed partnerships with several premier tribal operators, including Four Winds Casinos, Desert Diamond Casinos, Soaring Eagle Casino and Resort and Seneca Gaming Corp.”

Rob Lekites, vice president of sports and operations for the innovative technology provider GAN, says it’s never too early to consider installing a sportsbook.

“As tribes consider the regulations, sitting down with each tribe to understand their goals, objectives, and most importantly, internal processes is key to always being a step ahead of pending regulation,” he says. “Usually a tribe needs anywhere from 18 to 24 months of planning from visualization to anticipated launch of their sportsbook.”

Lekites says there are lots of differences between commercial and tribal sportsbooks.

“First, which is the most obvious, is branding,” he says. “Bringing a commercial book onto your property breaks up the existing brand your players know and love, and introduces a new competitor within your casino walls. Second, the size of the book. Usually, commercial books bring large budgets, which requires a good chunk of space and high-end look and feel. Tribal sportsbooks can very easily integrate within a casino’s existing floor and infrastructure, which offers cost savings.

“Finally, localization of lines and events. Commercial books are standardized across the board with a cookie-cutter approach, where a standalone tribal sportsbook allows you to truly localize to your specific market, while incorporating the book within your day-to-day on-property marketing strategy.”

Asher references the Oneida Casino near Green Bay, the home of the NFL Packers.

The Oneida Nation’s sportsbook in Wisconsin

“The Packers have a pretty rabid fan base, and they’re an official partner with the Oneidas,” he says. “There’s actually an Oneida gate at Lambeau Field. Throughout the season on a Sunday, everybody’s betting the Packers, so the obvious question is, if the Packers are winning or covering, we’re going to lose money. But I’ve been around this long enough to understand how it works. Everybody knows what the point spread is, and you want to offer a fair point spread. You don’t want to jack up the line and upset customers. When they win, great, give them the money, and they’ll come back the next week. We’re not worried about one game.”

Kambi’s Bretnitz says tribes are in a unique position when it comes to operating their own sportsbooks.

“There are many similarities between commercial and tribal sportsbooks, but also unique challenges and opportunities for each,” he says. “The main consideration is which commercial model to deploy. The first option is a B2C approach, or a market-access deal, which allows them to leverage a household brand to attract customers.

“However, if a tribal operator already believes in the strength of their brand and customer database, they may choose to work with a B2B sportsbook provider such as Kambi, launching sports betting under their own brand and taking full ownership of the relationship with their customers.

“While both routes are viable and come with their own benefits depending on an operator’s particular approach, a B2B partnership may also allow the tribe to return more profits to their community.”

Retail or Mobile

A retail book will soon become a staple for tribal casinos as sports betting continues to grow across North America. There’s really nothing like the excitement of an NFL Sunday or March Madness inside your casino when players can bet money on the games.

Most tribal sportsbooks won’t look anything like the Superbook at the Westgate in Las Vegas or the world’s largest sportsbook at the Circa in Downtown Las Vegas. But that doesn’t mean the excitement level will be anything less.

Sportsbook Lounge at Four Winds New Buffalo in Michigan

When HBG created the sportsbook at the Four Winds casino in New Buffalo, Michigan, it was designed for comfort. The Sportsbook Lounge is adjacent to the casino floor to take advantage of the surrounding gaming excitement. It’s designed to be a comfortable yet active retreat where guests can watch football, basketball, baseball and hockey action, while never having to leave the gaming floor environment.

The lounge’s custom layout and design provide sports fans with a comfortable ambiance to enjoy a beer while cheering on their favorite teams on any of the venue’s 22 televisions. Above the bar and on a large-scale central column are eight 85-inch, six 65-inch and eight 43-inch screens for ideal viewing from sectional sofas and lounge chairs, casual dining tables with chairs, and bar stool seating at the large sports bar.

Frank Freedman, chief operating officer of Four Winds Casinos, says the response of the customers has been very positive.

“We feel the layout, design and finishes will provide guests with the right ambiance, comfortable seating options and splendid views of multiple screens to enjoy a refreshing beverage or cocktail while cheering for their favorite teams,” he says. “Every addition we’ve made to our Four Winds Casinos locations has been for the sole purpose of enhancing the guest experience, and we’re thrilled to be able to offer this new amenity at Four Winds New Buffalo.”

Bretnitz believes that collaboration is an important part of tribal sports betting.

“Kambi takes on a consultative and collaborative approach, working closely with tribal operators to effectively develop their on-property retail strategy,” he says. “This includes sportsbook design, kiosk layout and seating arrangements that provide the best wagering experience. Some of the most successful sportsbooks are retrofitted from existing on-property venues, such as sports bars.

“Kambi will also provide strategic support in selecting your hardware provider. Our company works with three different kiosk providers. Of course, there are factors to consider, such as which states the providers are licensed to operate in, as well as logistical issues like supply-chain demands. For those reasons, working with different kiosk providers eases our partners’ concerns about getting up and running as soon as possible.

“It’s entirely up to the operator how they want to utilize their space, and they can choose between a traditional freestanding kiosk or a countertop terminal that’s great for sports bars within the casino. There are more than 900 Kambi kiosks in operation throughout the U.S., which provide a great alternative to over-the-counter services and provide a pressure-free environment in which customers new to sports betting can familiarize themselves with our offering.”

In Michigan, most tribes have opted to also offer mobile gaming, most likely because the state’s three commercial casinos in Detroit offer mobile, as do the racetracks.

For Wisconsin’s Oneida tribe, however, mobile is only offered on-property. Asher says that’s the choice the tribe made.

“At IGT, we can give them to tools to compete in the mobile market or just limit the betting to a retail location,” he says. “Oneida decided to offer mobile but geofence it to the property location. Either way, it’s working out for them.”

Bretnitz says much of a tribe’s decision to offer mobile sports betting on-property is due to state regulations.

“If legislation permits, some casinos may seek to encourage wider use of mobile devices on their premises, which is why Kambi has seen success with its Bring-Your-Own-Device functionality that can be leveraged to allow for an easy and exciting on-property sports betting experience,” he says. “BYOD is conducted in a contactless manner, creating a more user-friendly experience. The technology enables bettors to view lines and construct bets anywhere, before confirming them at the casino. A significant proportion of over-the-counter wagers at our partners’ casinos are placed using this technology, significantly reducing wait times during busy periods. In turn, it can help to familiarize customers with a tribe’s online identity, paving the way for an expanded offering as regulation permits.”

GAN believes it’s a question of what the tribe wants out of sports betting when deciding whether to allow mobile betting.

“This depends on a property’s long-range strategy, as well as where online regulation currently sits within their state,” says Lekites. “Either way, a property will need a player account management (PAM) system to implement mobile sports betting whether it’s on-property (mobile on premise) or statewide mobile.

Many tribes resist mobile sports betting because they want players on-property.

“Mobile On-Premise allows a property to stand up their iGaming infrastructure to be ready for statewide mobile, but it also allows a property to start building its online sports database, which will reduce a property’s online customer acquisition cost which is averaging around $700 across the U.S.”

But tribes want customers to travel to the casinos, giving the property multiple chances at the customer’s wallet. Some believe mobile will actually decrease that ability.

“It’s easy to understand that tribes may fear that could happen; in actuality, on-property and mobile players are two different types of players,” says Lekites. “Retail players (males 49 -65) will want to come on-property to place bets in person for various reasons (e.g., anonymous wagering), but a majority of sports bettors (males 18-49) want the ability to bet anywhere, at any time, on any device. This allows tribes to tap into a new segment of player whose personal habits are not coming to a casino as a daily activity, which taps into a large audience for your database.

“In addition, this enhances a property’s cross-sell marketing strategy to drive more and new players to the floor. Multiple industries from music to newspapers to television have gone through this type of digital distribution, and brands that are prepared to extend their omnichannel marketing strategy to digital will be able to use their strong local brand and enter into this new digital age of iGaming.”

Sporting Chance

It’s clear that sports betting can mean as much to tribal casinos it does to commercial casinos. IGT’s Asher says the opportunities are endless.

“Folks realize sports spending brings people into the property,” he says. “There’s no doubt about it. And then once you’ve got them in the property, you’ve got a shot to get them to do something else, whether it’s play the tables or slot machines, eat in a restaurant, enjoy the spa or whatever. I think sports betting is the single greatest customer acquisition tool in the history of the U.S. casino industry.”

Bretnitz is optimistic about the possibilities.

“The future for tribal sports betting has never looked brighter as we head into 2022,” he says. “Tribal gaming enterprises are leading the way in new forms of gaming and technology, and the Indian gaming community’s goal remains to provide best-in-class entertainment experiences for the benefit of their patrons and communities alike. They’re constantly looking for new ways to differentiate and innovate, and the advancement of technology will continue to influence the industry. For tribes looking to offer sports betting, investment in market-leading technology should be at the top of their list.

“For years, tribes have not only invested heavily in their properties, but also their people. As they move forward with sports betting, wherever they are in the process, they’re in a strong position to build on their progress in 2022 and beyond. Having the right partnerships in place can be the first step on the road to long-term success.”

With the growing popularity of sports betting, Lekites believes Indian Country will play a big role.

“Sports bettors will always want the ability to place sports wagers at any time and any place,” he says. “I think we’re going to get a lot more data from tribes that have implemented online sports betting in Michigan and Arizona in the next several months that will help expand the conversation. Overall, GAN stands with Indian Country to support whatever regulation protects their interests, players and competition in the marketplace today, as well continue to serve and educate each tribe’s specific strategy for sports based on their own day-one regulation.”

Salerno says the acquisition of US Bookmaking by Elys will enhance his company’s ability to serve its tribal clients.

“We were looking for the right technology partner for three years before the acquisition,” he says. “That transaction brings US Bookmaking into a company that now can offer a complete turnkey sportsbook in-house. By having the technology and bookmaking operations under one roof we can enhance the platform and accelerate the deployments with new clients.”