The Washington state tribal gaming industry presents one of the most unique landscapes across the country. On the surface, Washington is one of the fastest growing states in the country, and the expansion seen around the Seattle and Tacoma markets mirrors the expansion seen in demographics across the state.

However, the legal requirements around slot machines here, and part of the region’s dependence on international customers, make the state a one-of-a-kind—and potentially disadvantaged—gaming marketplace. In this article, we examine the current state of the dynamic tribal gaming industry in Washington and consider how a variety of elements are impacting the market.

Tribal gaming in Washington state dates to 1992, when the Lummi and Tulalip tribes opened their first, tables-only casinos north of Seattle. Since then, the industry has exploded with the state’s 29 federally recognized tribes now all holding Class III gaming compacts. Currently, 22 of those tribes operate 28 casinos, totaling more than 30,000 slot machines, roughly 600 table games, and nearly 3,000 hotel rooms across the state.

Outside of these casino facilities, tribal operators also compete with 41 commercially owned, house-banked card rooms (operating roughly 550 tables). These are mostly located around Seattle and Tacoma, but also spread across the state in Spokane, Yakima and East Wenatchee, among other cities.

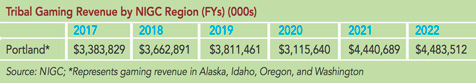

The following table highlights the tribal gaming revenue from the Portland Region of the National Indian Gaming Commission, which accounts for the revenue generated in Alaska, Idaho, Oregon and Washington. Of these four states, Washington contains the highest concentration of casino facilities. From 2017 through 2022, the region has grown from almost $3.4 billion to roughly $4.5 billion.

Lottery Model

A unique element of the Washington gaming market is the state’s Tribal Lottery System, created in 1998 to allow for gaming devices modeled after the state lottery. According to the Washington State Gambling Commission, the Tribal Lottery System is “a secured network comprised of servers, computers, player terminals, firewalls, switchers, cashier terminals, kiosks, and peripheral devices that communicate as a whole to provide the gambling experience in a casino.”

The system includes the casinos’ accounting system, the central determination system, and the player terminals (slot machines). As part of the system, “electronic scratch ticket” games became permissible—thus opening the door for a slot-like product—but must go through the state’s certification process. As a result, slot manufacturers do not put the same number of resources into producing Washington-specific slot machines as they do with traditional Class III machines, limiting the type of slot product available in relation to other markets.

Based on conversations with sources intimately familiar with the Washington slot market, the system does not have many negative competitive impacts around the Seattle and Tacoma region, where out-of-state competition is non-existent. The limitation of the system is more challenging to tribes in eastern and southern Washington, closer to Idaho and Oregon, where compacts allow for the traditional Class III machines seen nationwide.

One example, as noted by Lucky Eagle Casino & Hotel CFO Casey Riddle, is seen with Dragon Link, the highest-performing slot machine that is currently not available in either Class II or Washington Class III. Riddle points out that the limitation of the Washington market “makes it difficult to be competitive with adjacent states.”

Casinos in Major Cities Thrive

Despite these limitations, the casinos around Seattle and Tacoma are seemingly thriving. The area saw tremendous growth coming out of the Covid-19 pandemic period. Though, more recently, facilities located north of Seattle near the Canadian border may be experiencing impacts from a decrease in border crossings since the pandemic. Still, overall, the casino properties in these markets are growing and adding to their offerings.

The Emerald Queen Casino & Hotel in Tacoma had its grand opening in mid-2020, featuring more than 2,100 slots and 60 tables, as well as a 155-room hotel tower and various amenities, all costing around $400 million to construct. Snoqualmie Casino, located east of the Seattle suburb of Bellevue, is in the middle of a property remodel and expansion that will add a 210-room hotel, a 2,000-seat entertainment and convention space, new restaurants, an expanded casino floor, and several other new amenities, all of which are expected to open by early 2025.

One of the largest casinos in Washington State, the Tulalip Resort Casino will expand by another 70,000 square feet in 2024

Tulalip Resort Casino, the largest casino north of the Seattle area, recently announced a property expansion that will add 70,250 square feet to the existing 192,000-square-foot facility. According to Tulalip, the two-year project will expand the casino floor and add new guest amenities.

In the Tacoma area, Muckleshoot Casino Resort began the new year with the opening of its new 401-room hotel that includes a rooftop steakhouse and other new amenities.

Further south, close to the Oregon border, ilani Casino Resort opened its 289-room hotel in April 2023. With this level of expansion activity, there is little doubt that other casino properties in the region will follow suit to remain competitive.

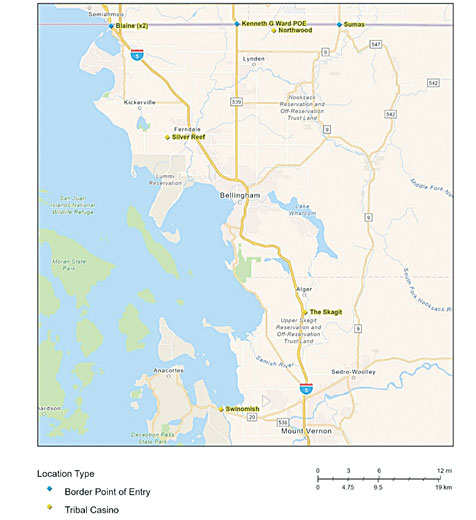

There is a pocket of northwest Washington that seemingly has not bounced back as quickly as the rest of the state; however, it is of no fault of theirs. For a long time, casino properties close to the Canadian border near the towns of Mount Vernon and Bellingham have benefited from the several million people that cross the border into Washington. As previously noted, these numbers have dropped since the pandemic.

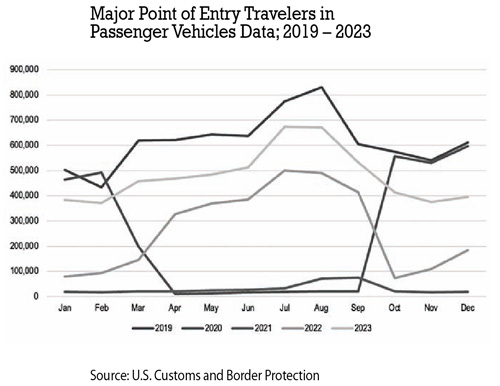

The Innovation Group analyzed border crossing data from U.S. Customs and Border Protection for the four major points of entry: Sumas, Kenneth G Ward Point of Entry (Lyden), and the two points of entry in Blaine (Blaine and Peace Arch) from 2019 through 2023. These points of entry and the nearby casino facilities are displayed on the map below.

Major Points of Entry in Northwest Washington – Source: ESRI; U.S. Customs and Border Protection

On an aggregate basis, the four points of entry totaled almost 7.4 million travelers in passenger vehicles in 2019. The pandemic essentially shut the border down with only 368,000 travelers in passenger vehicles crossing in 2021. Border crossings have been slow to recover and have yet to reach pre-pandemic levels—falling 215,000 travelers shy of 2019 levels in 2023 with 5.7 million travelers. While this data shows that border crossings have not bounced back yet, it is also important to consider that Canadian gamers who could not visit U.S. casinos during the pandemic may have found a replacement casino product north of the border.

The tribal gaming industry across the state of Washington is strong and steady. Despite the limitation of the Class III slot product, the casinos are quickly expanding and adding new, enticing amenities to keep the customer base interested and engaged. Looking forward, the state continues to grow and establish itself as a top U.S. destination. Washington state was ranked the No. 2 state to live in 2023 by U.S. News & World Report. The casino industry is keeping pace and maintaining its place as an important economic driver for both its tribes and local communities.