Minnesota’s casino gaming landscape is defined exclusively by tribal gaming operations, regulated through compacts between the state and sovereign tribal nations.

A vital component of the state’s overall economy, this structure reflects both the state’s respect for tribal sovereignty and the critical role tribal gaming plays in supporting economic development and self-determination for Minnesota’s Native American communities. In this article, The Innovation Group provides historical context for both tribal nations and gaming in the state, outlines and examines current gaming segments, explores the opportunities and challenges around the introduction of sports wagering, and illustrates the overall market potential.

Minnesota’s Tribal Nations

Minnesota gaming cannot be understood without first recognizing the rich history and ongoing presence of the state’s 11 federally recognized tribal nations.

The Dakota people, Minnesota’s first inhabitants, have lived in the region since time immemorial, with their traditional territories spanning much of what is now southern and central Minnesota. The Ojibwe people began arriving in the region in the 1700s, gradually establishing communities across northern Minnesota’s forests and lakes region.

Today, Minnesota’s tribal nations include seven Ojibwe bands (Bois Forte, Fond du Lac, Grand Portage, Leech Lake, Mille Lacs, Red Lake, and White Earth) and four Dakota communities (Lower Sioux, Prairie Island, Shakopee Mdewakanton, and Upper Sioux). Despite their distinct histories and traditions, these nations have found common ground in their approach to economic development, particularly through gaming operations.

The Minnesota Indian Gaming Association (MIGA) serves as a unified voice on gaming matters for most of these nations, demonstrating how historical rivals have evolved into powerful modern allies in pursuit of economic self-sufficiency.

The tribes’ gaming operations reflect their diverse geographical and economic circumstances. Some nations, particularly those near the Twin Cities metropolitan area, have developed world-class gaming and entertainment destinations that generate substantial revenues for tribal programs.

Others, especially those in more remote locations, operate smaller facilities that, while more modest in scale, play crucial roles in providing employment and supporting essential tribal services. This diversity in scale and scope demonstrates both the opportunities and challenges facing tribal gaming in Minnesota.

History of Gaming in Minnesota

Minnesota’s relationship with regulated gaming evolved through distinct phases, from early charitable gambling to today’s sophisticated tribal gaming operations. The state first entered the gaming sector in 1945 by legalizing charitable gambling, allowing organizations to raise funds through bingo and raffles. In 1981, pull-tabs were introduced, laying the groundwork for what would become one of the nation’s largest charitable gaming markets.

The most significant transformation in Minnesota gaming began with the federal Indian Gaming Regulatory Act (IGRA) of 1988. Unlike many states that initially resisted tribal gaming expansion, Minnesota moved quickly to embrace the opportunity, becoming one of the first states to negotiate tribal-state compacts. By 1991, all 11 tribal nations in Minnesota had secured compacts allowing them to conduct both Class II and Class III gaming operations.

Minnesota’s approach to these compacts proved uniquely beneficial to tribal economic development. Unlike many other states that demand moderate to significant revenue sharing, Minnesota’s compacts only require tribes to cover the costs of regulatory oversight. This arrangement allows tribes to retain 100 percent of their gaming revenue—a crucial factor that enables tribes to reinvest in their operations and communities, and that contributes to the market’s internal sustainability and external competitiveness to this day.

This compact structure also has proven particularly important for smaller operations that might not have remained viable under a revenue-sharing requirement.

Tribal Casino Market

Today, Minnesota’s tribal gaming market comprises 19 casinos operated by 11 federally recognized tribes across the state. The scale and success of these operations vary significantly based largely on geography and market access. Combined, these facilities offer approximately 20,000 slot machines and 275 table games as well as extensive hospitality amenities, including hotels, restaurants, entertainment venues and conference facilities.

The market demonstrates a clear geographic divide in terms of revenue generation potential. Casinos in or near the Minneapolis-St. Paul metropolitan area, such as Mystic Lake (Shakopee Mdewakanton Sioux Community) and Treasure Island (Prairie Island Indian Community), benefit from consistent access to a population base of more than 3.5 million people. These operations have developed into full-scale entertainment destinations, featuring luxury hotels, multiple dining venues, and significant convention space.

In contrast, casinos in northern Minnesota operate in a fundamentally different market environment. While properties like Fortune Bay (Bois Forte Band) and Seven Clans Casinos (Red Lake Nation) successfully attract tourism and seasonal visitors, their more remote locations and smaller year-round population base create distinct operational challenges. These facilities have adapted by developing unique amenities suited to their markets—for instance, Fortune Bay’s acclaimed golf course and Seven Clans’ water park attract visitors beyond traditional gaming customers.

Based on regional data from the National Indian Gaming Commission (NIGC) and industry sources familiar with the Minnesota market, total tribal gaming revenue is estimated between $1.75 billion and $1.95 billion annually. However, this revenue is not evenly distributed, with metro-area casinos capturing a disproportionate share of the market. Despite these disparities, even smaller operations play vital roles in their local economies, often ranking among the largest employers in their regions.

Charitable Gaming

While tribal casinos form the foundation of Minnesota’s gaming industry, other forms of legal gambling contribute significantly to the state’s gaming economy. These segments, particularly charitable gaming, have evolved alongside tribal casinos, sometimes creating complex dynamics around market share and gaming policy.

Minnesota hosts one of the nation’s largest charitable gaming markets, dominated by pull-tab operations. While traditional charitable gaming activities like raffles and bingo continue to serve rural and urban communities alike, they represent less than 5 percent of charitable gaming receipts. The real engine of charitable gaming lies in pull-tabs, especially their electronic variant.

Minnesota hosts one of the nation’s largest charitable gaming markets, dominated by pull-tab operations. While traditional charitable gaming activities like raffles and bingo continue to serve rural and urban communities alike, they represent less than 5 percent of charitable gaming receipts. The real engine of charitable gaming lies in pull-tabs, especially their electronic variant.

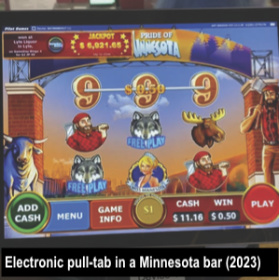

Legalized in 1981, traditional paper pull-tabs became a fixture in bars and taverns across Minnesota. However, the market transformed dramatically in 2012 when the legislature authorized electronic pull-tabs to help finance the Minnesota Vikings’ U.S. Bank Stadium. This initiative proved remarkably successful—so much so that the stadium debt was retired 23 years ahead of schedule.

The path to electronic pull-tabs’ success sparked significant controversy. Minnesota’s tribal nations have consistently opposed electronic pull-tabs, arguing they are a violation of their exclusive rights to slot machine gaming under the state compacts. While early adoption was slow, electronic pull-tabs gained enormous popularity with the introduction of features like free plays, bonuses, and an “open all” function allowing players to reveal all three lines with a single tap—functionality that critics noted closely resembles slot machine operation.

This similarity led to continued legal challenges, culminating in a February 2023 Minnesota Court of Appeals ruling and subsequent legislation (HF1983) prohibiting the aforementioned “slot-like“ functions on electronic pull-tabs, effective this year.

The debate continues, with current legislative efforts seeking to repeal this prohibition. Advocates for repeal argue that removing these features would significantly harm charitable organizations and their beneficiaries, while tribal interests maintain that clear operational delineation between electronic pull-tabs and slot machines is crucial to tribal exclusivity and the gaming compact framework.

Other Gaming Segments

The Minnesota State Lottery, established in 1988, represents another important gaming segment, with annual sales approaching $800 million in FY2024 (the third-highest total on record). These revenues primarily support environmental and educational initiatives across the state.

The state’s parimutuel sector, comprising Canterbury Park and Running Aces, offers both horse racing and card room operations. Last year, parimutuel wagering on horse races reached nearly $80 million while card rooms generated $87.8 million in revenue. These venues have established themselves within Minnesota’s gaming landscape through poker, blackjack and other table games, operating under separate regulatory frameworks from tribal casinos while competing for many of the same gaming customers.

Expansion & Amenities Development

Minnesota’s tribal casino landscape has evolved significantly from its early days of bingo halls to today’s multi-faceted entertainment destinations. This evolution is particularly evident in the Twin Cities market, where Mystic Lake Casino Hotel (Minnesota’s largest casino) features a 766-room hotel tower, extensive convention facilities, and multiple entertainment venues, setting standards for amenity development in the region.

Similar expansion has occurred at other properties, with Treasure Island Resort & Casino developing significant entertainment capabilities, including a 16,000-seat outdoor amphitheater, substantial RV park facilities, and a water park.

These investments reflect the industry’s shift toward diverse entertainment offerings beyond traditional gaming. The trend continues with more recent developments like Grand Casino’s comprehensive renovation of 1,100 hotel rooms at its Mille Lacs and Hinckley properties in 2024. And expansion is not unique to the Minneapolis metro; Seven Clans Casino Warroad’s also recently expanded, adding a new sports bar and gaming space for more than 100 machines.

These ongoing investments respond to both changing consumer preferences and competitive pressures from neighboring states. Iowa and Wisconsin, offering both commercial and tribal gaming, have pushed Minnesota operators to continually enhance their facilities and amenities, especially those properties near state borders where out-of-state venues actively compete for Minnesota customers.

Sports Betting

Sports betting represents a significant potential expansion of Minnesota’s gaming landscape. While aforementioned neighboring states like Iowa and Wisconsin already have embraced legal sports wagering, Minnesota’s path to legalization has been complex, with the state’s tribes playing a central role in the ongoing discussions.

Several other politically powerful stakeholders also are influencing would-be legislation: the professional sports teams (who stand to benefit from large sponsorship deals), racetracks (whose influence continues to enable them to benefit from casino gaming-adjacent efforts), charities (who don’t want to lose market share of the state’s gaming economy, and who also carry substantial legislative weight), and national and multinational sportsbook operators (whose sheer size and revenue allow them to wield tremendous lobbying power).

Above all these interests stand the tribal nations, whose sovereign rights and economic interests historically have shaped, and often constrained, Minnesota’s gaming expansion. While tribes operate all casino gaming in the state, sports betting’s mobile market creates unique regulatory challenges that have forced tribes to consider new operating frameworks.

The 2023 legislative session showed promising momentum, marked by rare bipartisan cooperation and unprecedented agreement among key stakeholders. MIGA expressed support for sports betting legislation that would maintain tribal control over the market. This marked a significant shift from previous years, where tribal opposition to any gaming occurring off-reservation had been a major roadblock to legalization efforts.

Despite this progress and continued stakeholder alignment into 2024-2025, new challenges have emerged. While the fundamental framework—including tribal control of the market—has broad support, the specific requirements around responsible gaming and problem gambling protections have become significant points of contention.

Notwithstanding seemingly strong backing from tribes, teams and tracks alike, Senator Matt Klein’s SF757 failed to advance from committee due largely to debates over such measures. The political divide, which is not entirely along party lines, is between those who believe that mobile sports betting is a social ill requiring the country’s most stringent consumer protection measures and those who believe that these measures would cripple the industry’s ability to effectively operate.

For example, the bill legislates a default setting for maximum daily deposit ($500) and loss ($500). And while a player would be able to change settings to make this less restrictive, the bill also would require this change to not take effect for seven days (yet by contrast, player requests to make these values more restrictive would be required to take effect immediately).

Further, upon hitting a limit, operators would have to notify the commissioner, who would notify other operators, creating the operational nightmare of books having to limit players in real time based on commissioner notifications. Perhaps a larger issue, the legislation mandates a three-hour “cooling off” period after any deposit, during which bettors would be unable to wager. Such a constraint would be unimaginable at a casino ATM.

These restrictions would create operational friction that many industry stakeholders argue would push consumers toward illegal offshore betting sites, where no consumer protections exist and where the state generates no tax revenue. Furthermore, operators contend these measures go far beyond responsible gaming practices seen in any other U.S. jurisdiction, making Minnesota’s market potentially unviable before it begins.

The current legislative landscape includes multiple bills under consideration, but achieving consensus on these specific regulatory details has proven challenging. This situation underscores a crucial dynamic in Minnesota’s gaming policy: while there is growing acceptance of sports betting in principle, any expansion of w

The tribes, having shown unprecedented willingness to embrace sports betting under the right conditions, now find themselves in the unusual position of balancing the operational needs of their would-be commercial partners and the evolving political realities of their state’s (and the country’s) views on gaming. This demonstrates well how dramatically the conversation has shifted from previous years’ debates over tribal exclusivity to more fundamental questions about market and political viability.

A Look Ahead

Minnesota’s gaming industry stands as a testament to the economic and political influence of the state’s tribal nations. From the early compact negotiations that established tribal gaming exclusivity to current debates over sports betting legislation, tribes have consistently shaped gaming policy while adapting to evolving market conditions. The disparity between metro and rural casino operations highlights both the opportunities and challenges facing tribal gaming, yet all operations continue to provide crucial economic support for tribal communities.

As Minnesota considers expanding into sports betting and grapples with questions around electronic pull-tabs, the fundamental partnership between the state and its tribal nations remains central to gaming policy discussions. This relationship, built on respect for tribal sovereignty and recognition of gaming’s role in supporting tribal self-sufficiency, continues to distinguish Minnesota’s approach to gaming regulation and development from other states.

Looking ahead, Minnesota’s gaming industry faces both opportunities and challenges. While market saturation and competition from neighboring states create pressure for innovation and investment, the industry’s strong foundation in tribal gaming provides stability and clear policy frameworks for future development.