In 2006, when Stephanie Bryan became the first female vice chair of the Poarch Creek Tribal Council, she had to fight to make her views known.

“In meetings, my suggestions sometimes fell on deaf ears,” she says. “Then, an hour later, when a man said the same thing, it was, ‘Great idea.’”

As the only woman on a nine-member council, Bryan took the selective hearing in stride. “I let them know I knew,” she says. “But a good leader doesn’t need credit as long as the job gets done.”

Though the Alabama tribe is matrilineal, with ancestral kinship traced through the female line, some male leaders openly said a woman wasn’t fit for the highest leadership positions. Bryan set out to change their minds. “Eventually, they saw my drive and intellectual ability, and finally said, ‘She can do great things for our tribe.’” In 2014, she became the first woman CEO and chair of the Poarch Creek Band.

Stephanie Bryan, CEO and Chairwoman, Poarch Creek Tribal Council

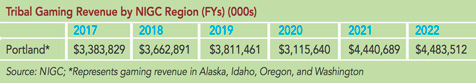

Among her first and most important goals was a “10-year vision” to diversify the tribe’s portfolio beyond gaming. Today, the Poarch Creek Band is an economic powerhouse with 42 separate enterprises: hotels, manufacturing, government services and aviation. It operates convenience stores as well as casinos; its media arm just won a NASA contract worth up to $217.6 million.

But the gaming side is still in full growth mode. Wind Creek Hospitality, which started with a single bingo hall in 1985, now operates nine casinos and casino resorts in the U.S. and the Caribbean. A 10th will open this summer in Chicago. Last year, the tribe spent $96 million to purchase Miami’s Magic City Casino, with plans to redevelop the site.

A Village of Support

By any standard, Bryan grew up poor. But the “little Indian girl from Poarch” was rich in role models: tribal women who met hardship with tenacity. When Bryan was a young single parent, juggling three jobs, attending college and raising two children, help was always close by.

“My mom, my aunts, my sisters and a lot of women in the community and church played a pivotal role in shaping me into the person I am,” Bryan says. “They taught me to believe in myself, and whatever I did, to give it 100 percent. If not for them helping me, it would have been so easy to say, ‘I give up.’”

Fortunately for her tribe, she did not. Since her early days as vice chair, tribal revenues have grown more than 1,200 percent.

“God blessed me to be very strategic and analytical,” Bryan says. “And we have done exceptionally well.”

According to a 2019 report by LeanIn.org, women hold just 21 percent of C-suite positions, but often outperform men once they reach the top. The study credited the so-called “soft skills” that are sometimes undervalued in the corporate realm: empathy, communication, emotional intelligence and a willingness to listen.

Most women still take care of home and family as well as business, and may naturally be more mindful of the impact of one on the other. Early in Bryan’s career, for example, she wrote block grants for child care and education, worked to secure health insurance for all tribal members and employees, and helped develop a new health clinic and assisted living facility on the reservation.

“For me,” she says, “the passion and motivation came from wanting to help improve the quality of life for people, male and female.”

‘Those Ladies Were Pretty Tough’

Melanie Benjamin, Chief Executive, Mille Lacs Band of Ojibwe

“Women are nurturers and multitaskers—it’s in our DNA,” says Melanie Benjamin, chief executive of the Mille Lacs Band of Ojibwe in Minnesota. “We think more about making sure everybody is included in decisions.”

Benjamin, too, has witnessed the perseverance of tribal women facing systemic oppression. When she was young, her family moved from the reservation to the projects of St. Louis as part of the Bureau of Indian Affairs’ voluntary relocation program.

The plan was launched in the 1950s to assimilate Native Americans into the broader culture, but in many cases, did not provide a leg up. According to the National Archives, participants often faced “unemployment, low-end jobs, discrimination, homesickness and the loss the traditional cultural supports.” Benjamin’s mother worked multiple low-wage jobs to support her brood of 12. Even then, “if someone in the neighborhood was down and out, she would feed them.

“Our women have always struggled because of being Native American,” Benjamin says, “but those ladies were pretty tough, too. I don’t think I ever met anybody as strong as my mom, and she instilled that strength in all her kids.”

The family eventually moved back to Minnesota, where Benjamin pursued a degree in business administration. That led her to tribal government.

“At the time, you didn’t necessarily see women in government leadership, but people in your circle of friends and at work were willing to say, ‘I recognize a gift or a potential in this young woman.’ I always happened to be in the right place at the right time for opportunities—and I went for them.”

The Leader as Servant

Benjamin had a mentor in the late Marge Anderson, the first woman tribal leader in Minnesota, who is remembered for a historic, years-long battle in federal court to defend the tribe’s hunting and fishing rights—a battle she won. Anderson also presided over the development of Casino Mille Lacs and Grand Casino Hinckley in the early 1990s. Revenues from the properties funded much-needed housing, schools and clinics on the reservation.

During her own time as chief executive, Benjamin waged another important battle when Mille Lacs County officials challenged the very existence of the tribe’s 61,000-acre reservation, insisting that an 1855 treaty laying out its boundaries was no longer in force. She won that skirmish in 2022, when the treaty was reaffirmed by the state and federal governments.

Benjamin believes in author Robert K. Greenleaf’s concept of “servant leadership,” which holds that companies and communities are healthiest under leaders who are “proven and trusted as servants.”

“That is an American Indian model,” says Benjamin. “We’ve lived that value system since the beginning of time with bravery, compassion, love, wisdom, honesty and truth, sometimes called the ‘grandfather teachings.’”

That model is espoused by Ashley Hemmers of the Fort Mojave Tribe, who led a successful campaign to preserve half a million acres of sacred tribal land in Nevada. Hemmers has described the approach as “power with” versus “power over,” a model of cooperation instead of control.

Today, gaming is just part of the Mille Lacs business portfolio. Mille Lacs Corporate Ventures owns three hotels in the Twin Cities metro area, as well as a slot machine company, convenience stores, a food franchise and other enterprises.

In a 2023 State of the Band address, Benjamin said tribal members gathered “not only as survivors, but as architects of our own destiny,” who live by the Ojibwe motto, “Bimaadiziwin.”

“It means ‘the good life,’” she says, “and that’s what we all strive for.”

Poverty to Plenty

Lynn Valbuena, Chairwoman, San Manuel Band of Mission Indians

In past interviews, Lynn Valbuena of the San Manuel Band of Mission Indians has recalled members of her tribe living without electricity, accepting food from “welfare trucks,” and using outhouses with no toilet paper “but a big, thick Yellow Pages phone book.”

Times have dramatically changed for the San Manuel Band, based in Southern California. Since opening a bingo operation in the mid-1980s, the tribe has built an empire that includes the Yaamava’ Casino Resort in Highland, San Bernardino County and the Palms Casino just off the Las Vegas Strip, as well as hotels, a gas station and a shopping center.

Valbuena started her career at age 20 as the tribe’s first housing commissioner. She is now serving her fifth term as chairwoman.

In the 1960s, she says, there were actually more women than men in San Manuel government, as most of the men worked outside the reservation. “Our Articles of Association, adopted in 1966, were signed by six women leaders of the tribe,” she notes. “I took a role to help make social and economic progress for our community.” At the dawn of the gaming era, Valbuena worked double shifts: days at the city police department, nights at the bingo hall.

She says she’s happy to see more indigenous women in leadership, particularly in tribal government. “However, there are still far too many challenges that Native women must overcome to find their rightful place in the corporate and governmental hierarchy.”

To young women who would follow her, she says, “Have confidence in yourself as a leader, passion for the work, a commitment to a vision that will bring progress to your community and people, and a character that’s beyond reproach. That includes transparency, good communications, a strong moral compass and treating others like you want to be treated—with respect.

“It’s also important to heed the guidance of your ancestors and elders—that is, to never forget who you are or where you come from.”

Past as Prelude

One history of Native American women describes them as “pivotal to community survival,” holding positions of political power, controlling property, educating children and preserving oral traditions and language. A 2021 study published by the National Institutes of Health suggests that centuries of oppression took a toll on women’s leadership, acting “to reverse matrilineal gender norms in favor of patriarchy.”

In the corporate world, statistics still show appreciable gender pay gaps. In 2024, white women can expect to make just 81 cents for every dollar paid to white men, and the gaps widen based on ethnicity: 55 cents for Latina women, 64 cents for Black women, and 59 cents for Native American women. The latter pay gap reportedly can cost a Native American woman more than $1.1 million over a lifetime of work.

“We’ve proven over time that we are just as capable of handling the demands of high-level management and executive leadership positions,” says Valbuena, “yet we are too often denied advancements up the chain.” She believes these decisions should and eventually will be “based more on merit and character than old stereotypes.”

Bryan concurs. “Even in Indian Country, when it comes to income, a woman’s value is less, which bothers me. Male or female, it should be equal or equivalent, and a lot of times it really is not.”

She adds that tribes “get a bigger bang for their buck” if they welcome female leaders, who bring “intellectual ability and time management, and are great listeners, problem-solvers and multitaskers.

“So many times when men look at women, they think weakness. But if men had to birth the children, there wouldn’t be any.”

‘I Learned to Invite Myself’

Jeannie Hovland, Flandreau Santee Sioux Tribe, Vice Chair, National Indian Gaming Commission

In a 2023 retrospective marking 35 years of the Indian Gaming Regulatory Act, National Indian Gaming Commission Vice Chair Jeannie Hovland saluted generations of women in tribal leadership, including the late Judith Peterson, who negotiated the first Class III gaming compact in South Dakota; Gay Kingman, a “founding matriarch” of the National Indian Gaming Association (now the Indian Gaming Association); former NIGC chairs Tracie Stevens and Ada Deer; Lena Hammons, a “modern day woman warrior” and a founder of the annual National Tribal Gaming Commissioners and Regulators Conference; and many others.

“I am proud to be surrounded by strong indigenous women in gaming with whom ideas are shared, problems are solved and encouragement is found as we continue to shape Indian gaming into the positive force it is today,” she wrote on IndianGaming.com. “I look forward to seeing what the next 35 years holds.”

Hovland responded to questions from Tribal Government Gaming about her own rise, her role models and the characteristics of effective leaders.

TGG: There are so many great examples of women in tribal leadership, but is there more work to be done to ensure fairer representation?

Progress has been made in the gaming industry over the last several years, as we see more women serving as tribal leaders and council members, CEOs and executive directors of gaming commissions, and successfully running businesses and nonprofit organizations.

We have also witnessed history with the first Native American to be appointed as secretary of the interior, the Honorable Deb Haaland. I believe we must continue to progress in this upward trend of women leaders.

In corporate America, women occupy about a fifth of C-suite positions. Do Native women face the same barriers? If so, what are the solutions?

Speaking from personal experience, I feel barriers may exist, especially in positions traditionally held by men.

We need to continue to advocate for ourselves and for other women who we know are qualified candidates. We should also celebrate, support and encourage women in leadership positions. In the tribal gaming industry, I’ve been so pleased to witness both women and men supporting women in leadership positions.

What personal traits and business skills contributed to your success?

My mom served as a role model for me when I began my career with the federal government. Dating back to the 1970s, she worked hard her entire life in careers that were predominately held by men.

She taught me to be assertive but not aggressive, confident but not arrogant, and diplomatic. I learned quickly that I would need to invite myself to meetings, conversations and events. Eventually the invitations came after I established myself as a trustworthy, capable person who wanted to make a positive impact.

I recommend all who are in leadership to be genuine, eager to learn, humble, let people know when you don’t have an answer, follow through when you make a commitment and be a compassionate and present listener.

Are there misperceptions about women in leadership, and what should young professionals expect as they climb the ladder?

I think society perceives that people in leadership have it all together—or should. In fact, outwardly we may portray a professional demeanor, while inside feeling like we’re falling apart.

The expectation for women in the workplace is to remain professional, demonstrate intellect and present ourselves as respected leaders. Some may feel that this requires appearing unapproachable or portraying inferiority.

But as women, the leadership approach that often comes more naturally is presenting the same demeanor we do in our homes: being approachable and genuine in our interactions.

One of the greatest freedoms I have given myself is to use mistakes as an opportunity to learn and grow. I do not expect perfection. This pertains to all areas of my life, personally and professionally.